Sunday Business Post - News Feature - Dec 28 2008

Read the article on the Sunday Business Post website by clicking here.

Business representatives are calling on the government to address the funding shortfall facing start-ups in 2009. Patricia Callan, director of the Small Firms Association (SFA), said that the government’s €10 billion bank rescue plan, announced earlier this month, would do little to help young businesses dependent on bank lending.

‘‘I certainly do not think that the recapitalisation of the banks will have any direct impact on lending. We propose that the government, rather than just guaranteeing the banks, should guarantee the loans they give to small business,” said Callan.

‘‘The banks say they are giving out the amount of start-up finance and credit based on the current economic climate, and irrespective of the credit crunch. I do not think anyone believes that.”

As a potential solution, JJ Killian, chairman of the Irish Small and Medium Enterprise Association (Isme), urged the government to consider nationalising one of the Irish-owned banks, which could then provide credit to entrepreneurs who need it.

‘‘We could look at a situation where the state takes over a bank and runs it similar to the way ACC was run in the past. It would be a government bank and could guarantee loans to small businesses in various parts of the country,” said Killian.

He said the ‘‘state of inertia’’ gripping the Irish economy required decisive government action to return some degree of confidence.

‘‘Confidence is the critical factor in the economy at the moment. The confidence has been wiped away at every level,” he said.

‘‘The person who can afford to buy something this week, and is in a steady job, will not do it because everybody has become so cautious.

‘‘We need confidence to rebuild at every level, from the governments to the banks to the small business owners to the man in the street. The only way to rebuild this confidence is to find away to get money moving again.”

Claims among the country’s banks, that business lending activity is continuing, are misleading, said Killian.

‘‘They are open for business in that you can walk in and apply for credit, but they are not open for business in that there has been a subtle ratcheting-up of the criteria applying to companies looking for credit,” he said.

Callan agreed that start-ups seeking bank finance faced an uphill struggle. ‘‘The reality is that things have changed. The banks all talk about funding sustainable businesses, but that comes down to a personal decision,” she said.

‘‘How people are being treated is different now, whether it is the amount of detail they have to provide when making applications, the length of time it takes to make a decision, or the requirement for a personal guarantee to get a loan.”

Business owners who succeed in securing credit face higher rates, said Callan. ‘‘I would be particularly concerned at the cost of finance, which is a direct result of the high cost of money on the international markets due to the credit crunch,” she said.

‘‘We asked people whether the cost of finance increased over the last six months of 2008. Fifty-one per cent of our members said the cost of finance for working capital had increased, and 39 per cent said the cost of finance for investment purposes had increased.”

Callan said she was optimistic that the investment capital sought by the Irish banks from the European Investment Bank (EIB), earlier this month, would be made available.

‘‘The banks have met with the EIB and sought funds from the €15 billion fund that was set up for SMEs,” she said.

‘‘There was some dispute over whether that was for working capital or not, but my information from the EIB is that it can be given in the form of two-year term loans, which is just the type of finance that people need at the moment.”

Killian said that the government should ensure that any EIB funding secured would be made available to start-ups and small business owners.

‘‘The government needs to make strenuous efforts to go after the EIB funding,” he said. ‘‘There should be some way of channelling that so that we can see what is happening, and to make sure that it comes into the small business sector.”

Callan said that there were signs that the banks would make this money available to Irish small business owners and entrepreneurs.

‘‘In one week in December, each of the four major banks announced major SME funding initiatives. They are all saying they will retain their current levels of business and have given guarantees of new funds, so there should be more money available,” she said.

She pointed to some other potential sources of funding for new businesses.

‘‘First Step is a specific micro-finance funding initiative, which gets most of its money directly from the European Investment Bank.

‘‘The local county and city enterprise boards can give grants and finance, and we are putting pressure on the government at the moment to expand their operations.

‘‘If you are high-growth and exportdriven, you can go to Enterprise Ireland.”

Callan said that, despite the funding difficulties facing start-ups, new businesses continued to set up around the country.

‘‘Start-up numbers were up to maybe 18,000 in 2007.The numbers were distorted, though, by a lot of small construction companies starting up, which will now be out of the mix.

They might come back to around what we used to have, which was 12,000 or 13,000 per year.”

Tuesday 30 December 2008

SMEs push government on funding start-ups

Posted by

Dermot Corrigan

at

20:49

0

comments

![]()

Financial recruiters feel squeeze

Sunday Business Post - Recruitment Section - Dec 21 2008

The recruitment sector hasn't escaped the recession's clutches, with a grim 2009 lying in wait, writes Dermot Corrigan.

The financial crisis is forcing some recruiters targeting the market out of business, as competitors vie for a slice of a shrinking market. According to Anne Keys, director of financial recruiter IFSC Panel, it is a case of "survival of the fittest" for financial recruiters navigating a turbulent market that shows no signs of stabilising.

"There will be fewer recruitment firms in Ireland by this time next year," said Keys. "There are fewer financial services jobs to fill at the moment so there is more competition for roles. We are certainly losing some of our competitors, and others are laying off staff, particularly those who focused on junior level roles. ”

Risk management

Despite this, ongoing developments in the market have created demand for certain niche skills. One prominent example is risk - now a major concern for employers concerned with fraud and security issues in the wake of the Bernard Madoff debacle.

“Operational risk, market risk and credit risk are popular as companies are looking to see where they are at and what the internal and external risks in the market at the moment are,” said Keys.

Brian Murphy, managing director, Ireland, Premier Group, said that the number of compliance roles on offer in the Irish banking sector, and wider financial services market, would grow in the years ahead.

"I would suggest there will be a lot of procedural roles brought into the banking sector,” he said. “That particular niche area within banking and financial services will be very busy. Sarbanes-Oxley came to prominence after the Enron scandal, and for the next number of years you could not get enough of them.”

Recruitment Industry

Shay Dalton, managing director, Lincoln Financial Search & Selection, said that the recruitment industry was less able to withstand economic upheaval than some other sectors.

"Recruitment companies really lead with their chin in recessionary times and they can be badly hit," said Dalton. "It depends really on how well you are established in your market. Recent entrants into the market will suffer and possibly mid-tier firms, who grew a lot over the last three to five years, may have to scale back a lot.”

The downturn has hit recruiters heavily invested in the financial market harder than those with a broader focus, said Murphy.

"The financial services recruitment companies would probably have had it a lot harder than the general recruiters," he said. "If they are over-dependent on a small number of big clients who stop hiring, then it becomes difficult."

Keys said that some employers in financial services had opted to exclude recruitment agencies from the hiring process altogether, in an effort to cut costs, particularly for low-end roles.

“A lot of clients are going are going directly for junior roles," said Keys. "It is a big thing that we have seen. They use the recruitment firm more for middle to senior end.”

Quiet Christmas

Recruitment activity typically dies down in the run-up to Christmas but, according to Keys, the seasonal lull had a noticeably longer lead-in this year.

“Things went quiet this year quicker than any other year," she said. "Normally it gets quieter in December, but from the end of October onwards we have seen clients putting recruitment on hold until they see which way the market goes in the new year.”

“The financial services employers who have been hit harder by the downturn are now paying the price and have had to let people go," she said. "Some clients are going over the radar, but some are under the radar, depending on the number of people they are looking to make redundant.”

Murphy said that hiring freezes were holding sway across the banking sector.

"An awful lot of our customers in the banking sector would have hiring freezes in place," he said. "Anything related to the construction sector, such as mortgaging broking, professional lending and similar types of roles, are very quiet.”

Specialist roles

Despite the downturn in the financial services sector, Keys said that there were still opportunities for candidates with specialised skills.

“It is not that it is completely dead," she said. "There are some roles available, but just less of them. Some banks are looking at contract work, and mainly on the finance side. Contract accounting is definitely busier, but that tends to be the case towards the end of the year anyway.”

Keys said there were job opportunities in the financial services sector.

“A number of both domestic and overseas insurance companies are looking to recruit head of compliance type roles at the moment,” she said.

Transferable skills

Dalton said that many individuals attracted to the financial services sector during a period of sustained growth in recent years were now opting to leave.

"The financial services attracted top talent over the past ten years," he said. “There are currently options open, especially for accountants, within the commerce and industry sector. The transferable skills include traditional financial reporting, internal audit, risk and compliance, core analytical skills as well as areas such as taxation and corporate finance."

Dalton said some accountancy practices were keen to take on candidates with experience in the financial services sector.

"There is a trend for candidates who trained in practice, and who subsequently went into financial services and industry, to go back into practice," he said. "The skills they gain outside of practice complements the advisory experience they developed in practice."

Some candidates with niche skillsets find it more difficult to transfer to other sectors, said Keys.

“A lot of areas in financial services are quite niche, particularly in banking, treasury, fund accounting et cetera,” she said. “It is quite difficult to transfer that kind of skillset into another area.”

supply of candidates

Keys said that the difficulties faced by companies in the Irish financial services sector meant that there was a surplus of good quality candidates on the market heading into 2009.

“We are finding that there are way more candidates available immediately," she said. "Candidates who have either been made redundant, or their contract has finished and they have not been offered a new one.”

Dalton said that individuals in employment were less likely to move to a new employer, given the current uncertainty in the market.

"In many cases, financial services professionals are staying are remaining with their employers, rather than voluntarily enter a turbulent job market," he said.

Keys said that a “huge change” in the professional mindset of many candidates.

“Previously, most candidates who were currently working would always have been looking for other positions,” she said. “The only people currently actively looking are those who might be unsure of their current role within the company.”

According to Keys, a move overseas is on the cards for some candidates.

“Some may look to go out of Europe to locations that are up and coming, and where their skillset is in demand, such as Dubai," she said. "It is mainly banking skills that are required there at the moment. India is a place where there is lots of activity happening, but I do not see a rush of Irish people going over there.”

Salary trends

Keys said that the salaries offered for some finance roles had dropped significantly in recent months.

“Some candidates, at senior and executive level, who are currently available, are coming down maybe €20,000 from what they were on previously," she said. “I have not seen roles that were at €40,000 drop down to €30,000 but an employer might pay around €5,000 less than they might have done.”

Candidates who are out of work, when searching for a job, have little scope to negotiate with potential employers in the current market, according to Keys.

“Clients are now able to say ‘look, this is what I am paying’ and if the candidate is willing to work on that basis it will go forward,” she said. “But employers will not be matching expectations or past or current candidate salaries.”

Year ahead

Dalton said bonus payments would take a hit in the New Year.

"Many bonuses within financial services are paid in January and in many cases, these will not be paid or will be less than 2007," he said.

Keys said:

“It is very hard to predict what way the market are going. Most of the media are saying it will be 2010 (before it picks up), and that 2009 will be a difficult year. The expectation is that Q1 and Q2 will be difficult, but that there will be some pick up in the third and fourth quarters of the year. It will be a tough year, but there will still be roles to fill.”

Posted by

Dermot Corrigan

at

20:40

0

comments

![]()

Monday 29 December 2008

Global heavyweights feel pinch

Sunday Business Post - Executive Search and Selection Report - Dec 14 2008

As demand slows down, some of the world's biggest executive search and selection firms have already shed 40 per cent of their workforce. But the full impact of the downturn won't hit home until next year, writes Dermot Corrigan.

Demand for the services of executive search and selection firms has slowed significantly this year, leading to job losses internationally, but worse is to come.

"We have seen two of the biggest executive search firms (in) the world - Heidrick & Struggles and Korn / Ferry - already let go about 40 per cent of their own staff," said Karl Croke, managing director of Amrop Strategis in Ireland. "The number of senior management searches coming into organisations, in Ireland or abroad, has slowed significantly."

Croke said the early effects of the downturn had begun to take their toll on the executive search and selection market in September. The full impact would, he added, hit home next year.

"We expect to come back down to the figures we had in 2006. That is just reflective of the economy, and what is going on."

Employers are taking more time to fill executive roles, meaning longer processes and ultimately less business for executive search firms, according to Maurice Carr, managing partner, BDO Recruitment.

“The latter half of 2008 has been difficult,” said Carr. “The main outcome has been a slow down in demand and also a lengthening of the time that it takes to complete a processes due to fear and negative sentiment on both the sides of the employer and the perspective employee.”

By contrast, 2007 was a peak year for executive search and selection in Ireland, said Barry O'Connor, partner, Merc Partners.

"Our revenues this year would be well down on 2007, which was probably the best in our history,” said O’Connor. “We do not expect a massive increase in 2009 either, we expect things to be quiet again, in comparison to 2007.”

Sectoral trends

"Construction has taken a hammering, particularly house-building and development,” said Croke. “Financial services is also finding it tough, but most sectors are feeling the brunt right now."

"Everything is connected, and there is a flow through, and with confidence the way it is people are holding on to the few quid they have. There is a big degree of fear out there. Until we get to the bottom of the cycle, that is not going to change."

O’Connor said some sectors were holding up better than in others.

"Some elements of the financial services sector are still functioning - insurance, for instance,” he said. “We are also doing business at senior level for quite a few back-office type operations for financial services companies. Food, pharmaceuticals, retail, consumer goods and outsourcing are all still quite active."

Carr said that the healthcare and green sectors had strong growth potential.

“The multinational healthcare companies continue to be strong performers,” he said. “They are still recruiting at senior level, the environment is also an area that is showing increasing demand, but that probably has a year or two left before it is a major employer.”

Croke said that the global slowdown was forcing multinational companies with operations in Ireland to rethink plans to relocate elsewhere.

"The Intels and other similar multinationals which were moving operations to Poland or China seem to have consolidated here a lot,” he said. “That sector has strengthened in Ireland in the last year, which is (not what you would) have expected."

New opportunities

Croke said the response to the downturn, among search and selection firms, had been to diversify, to broaden the range of services on offer to clients.

"Executive search, for people to run organisations day to day, has slowed significantly,” he said. “However, that has been replaced by leadership products looking at board structure, management review and board review."

"Organisations are saying 'given all the change that is out there, that our strategy might no longer be relevant and we should review everything'. If the required strategy has changed, companies may need new people on the board, or in the management team, with different competencies and skills."

Carr said that BDO had refocused its own offering in response to the downturn.

"We have focused on new areas, including doubling our interim turnover, and also increasing our consulting fees, particularly in the area of performance management systems," he said.

John C Harty, managing director John C Harty Associates, said clients facing a more difficult marketplace were keen to work more closely with their executive search partners to help manage recruitment and HR processes.

“Over the final quarter of 2008, and into the first quarter of 2009, our clients are looking more than ever before for a partnership relationship,” he said. “Our clients’ key decision makers are relying on the executive search firm to guide them wholly through the recruitment process and also looking for some guidance on existing staffing structures.”

Interim management was particularly popular in the current climate," said Carr, "particularly with senior finance people across all sectors who have been recruited to deal with liquidity issues, but also the full spectrum of businesses in dealing with the decisions and actions that they need to take to deal with the changes in the economy. I believe this will be a very active area in our business.”

O’Connor said that there was still some demand from Irish companies with operations abroad.

"We have seen more international activity in 2008 than before, particularly assignments in association with our affiliates abroad,” he said. “We have had clients looking for Irish people to work abroad, and likewise Irish clients looking to recruit people abroad for their operations abroad. The latter is something that has been busier than in previous years."

Salary markers

O’Connor said the remuneration packages on offer at executive level had taken a hit in recent months.

"Anecdotally, I would feel that there is downward pressure on compensation, which is particularly coming from lack of bonuses, which seems to be happening in all sectors,” he said. “Bonuses are still being offered as part of packages, but expectations are much lower."

In some cases, however, Harty said, many companies were still willing to offer increased salaries to attract the right candidates.

“When a top executive is being head-hunted for a new role in a different organisation the overall package generally rises by between 12 per cent and 16 per cent to that of their previous role,” he said. “This trend is holding steady in those sectors not directly exposed to the downturn.”

Croke said media coverage concerning executive salaries and bonuses carried its own risks.

"It is reasonable to question some of the bonuses and salaries, but we need to be careful not to shoot ourselves in the foot, in financial services or anywhere else,” he said. “Really good executives can move internationally. Ireland cannot nail these people to the floor. You can liken it to liverpool football club. If you cut the players wages in half, they will head for Chelsea or Inter Milan. We still really need leadership at the moment."

Future trends

O’Connor said he expected the market to pick up slowly next year.

“We are not planning any expansion or anything like that, but our business is chief executives and function heads, and the demand for leadership talent grows as organisations come under pressure," he said. "The demand for the best talent out there may increase in the coming year, and we would hope that we can play a part in that."

Harty said his firm was looking outside the Irish market to grow its business in the new year.

“In 2009, we open offices in Abu Dhabi, Dubai and Doha,” he said. “Our aim is to search on a more global basis for all our assignments whether the role is based in Dublin or Doha”

Carr said that, as companies were forced to fight their way through a difficult economy, the services of executive search and selection agencies would be required.

“Although in the short term companies will be hesitant about making senior appointments, I see this improving in the first quarter of 2009,” he said. “Over the next number of years there will be a requirement for a higher performance from executives that this will create a demand in executive recruitment."

"The bar will also be raised in terms of the ability of people in the executive search market to deliver the quality of executive required.”

Panel: Advice for candidates

Executive-level candidates are increasingly insecure about the long term viability of their current roles, according to Karl Croke, managing director, Amrop Strategis in Ireland.

"The number of people who would like to have a cup of coffee with me is getting larger every day,” Croke said. “These are people at executive level who are concerned about their future and the role that they currently in. A number have been let go from various organisations. Some are in organisations where the writing is on the wall, and they are very concerned. Others who are in organisations where they can see a future, are thinking that maybe this is not a good time to take a risk and move."

Barry O'Connor, partner, Merc Partners, advised candidates to review all of their options.

"People need to look at how they will develop their career, and continue with that, regardless of the pressures in the general economy,” he said. “People have to look at whether they could do better, or be more effective or advance quicker in another firm. These are questions that executives should be asking themselves.”

Croke said that experienced candidates were finding more favour with employers.

"The law says that you cannot discriminate by age, but right now people with some grey hair, who have been through economic downturn before, are more valuable to organisations,” he said. “During the dotcom boom it was the 30-year-old gung-ho risk taker with huge energy seemed to be the flavour of the month. People who know how to manage through a difficult environment are now more interesting to companies."

O’Connor said the downturn had not affected which skills and talent employers typically sought from top-level executives.

"The fundamentals still apply,” said O’Connor. “Organisations still look for the competencies they have always sought, but they are looking for the best in those particular areas. Leadership is still a major requirement, as is commercial analysis and the ability to communicate and get people to buy into whatever agendas are required to rejuvenate organisations. Strategy also remains very important.”

John C. Harty, managing director, John Harty Associates, said international markets offered opportunities to Irish executives whose careers might have stalled at home.

“You have a greater pool of executive candidates in the market place who fear that their current position could be under threat,” said Harty. “My advice to senior executives would be to be as open as they can be to opportunities outside of Ireland. The more international experienced gained the better. The corporate world is changing and is about to change more dramatically. The era of outsourcing is about to (hit) the Western economies rapidly and those who do not follow or adjust to the global changing market place will be left behind.”

Posted by

Dermot Corrigan

at

19:33

0

comments

![]()

Monday 8 December 2008

Career breaks can keep everyone happy

Sunday Business Post - Recruitment Feature - Dec 7 2008

Career breaks are on the table for many companies looking to move staff off the payroll until the economy rights itself.

Permanent TSB (PTSB) recently announced a scheme to incentivise staff to take a two or three-year career break or voluntary sabbatical. Employee reactions to the scheme have been broadly positive, according to a spokesperson for the company.

The financial services company offered employees up to €20,000 to take a two-year break and up to €35,000 to take three years off. The total sum was offered as an upfront payment to a maximum level of half the employee's annual salary.

"It has been received extremely positively," said the spokesperson. "Staff see it as innovative, and its voluntary nature is attractive. We have received feedback over the last couple of years that staff would appreciate more flexible work arrangements; they see this as an option which meets this need."

While not releasing any figures on the take-up to date of the scheme, the spokeswoman said the company was happy with the number of applications thus far.

"We have received plenty of applications from all across the organisation," she said. "There is a mix of all employees applying ranging from three to over 20 years service, male and female, both Irish and non-nationals – reflecting our employee base."

"There is also a good balance between the two and three year option, depending on what people are planning to do during the career break."

Innovative approach

Janet Wallace, HR solutions consultant with Russell Brennan Keane, said that the PTSB offer provided an innovative way to managing staff costs in a downturn.

"It is a good way for companies to reduce their payroll costs over a certain period, while ensuring you can get your skills back for when you need them in two or three years time," said Wallace.

"You are not losing the investment you put into them from a recruitment and training point of view, and you keep the knowledge they have built up about your company. It is a lovely option to be able to give if you are an employer."

While those who take up the PTSB scheme are guaranteed a role in the company, similar to their current job, upon their return, Wallace said not all companies could offer similar promises in the present economic climate.

"That is a risk that individuals considering a career break have to take,” she said. “However, in the current climate there are other people who are not sure if their job is going to be there in two months time, never mind two years. It depends on the employee and the situation they are in. Some people might have a partner who would be able to keep them financially secure."

Wallace said candidates who did decide to take a career break, did so for a variety of reasons depending on their own circumstances.

"Over the past few years traveling has been a massive one for people, and especially younger staff might pick up on this,” she said. “Other people might want to go back and do further studies. Some other people might have family commitments, they might have young children and would like to take a couple of years out, knowing they had the security of a permanent job to go back to."

Volunteering Derek Bambrick, business manager with recruitment firm Abrivia, said employers generally looked more favourably on staff who use their time out of the company to develop new skills or experiences.

"Employers often give career breaks to people who they value, but if they offer a career break they like to see the individuals putting something else on the table when they return,” said Bambrick. “If it is well planned and constructive, a career break can be advantageous to any employer."

Bambrick said Abrivia had recently placed a candidate in a senior financial services position on his return from a two-year career break.

"This gentleman was an accountant and had six years experience post qualification,” said Bambrick. “He and his wife, who is a pharmacist, were just married. He decided he wanted to do some voluntary work, so he joined up with VSO (an international development charity) and worked in an international development role in Africa. He went away with numbers in his head, but he came back with very strong project management skills. He had the skills of a sales manager, and had the life experience to go into a country management type role."

Upon his return, Abrivia was able to place the candidate with his old company - and in a more senior role.

"When he came back he had to renegotiate another contract,” he said. “He was so well thought of that they nearly created a job for him. As he had a whole new list of talents, and a new skillset, his career was given a boost."

In general, however, it is not typical for employers to keep positions open for staff who leave the company for a year or more, Bambrick said.

"It depends on the relationship you have with your employer,” he said. “If you come back and reapply for a job, you will be in a good position with the new skills and experiences that you have picked up."

Secure new role

Bambrick said those who take a career break, without any guarantee from their current employer, could find that new employers are interested.

"Somebody might want to do voluntary work, and another person might want to go to university or something like that,” he said. “But as long as they can show value to the job market, and attain new skills and keep up with the existing skills they have, they will do very well."

Bambrick said more companies were introducing career breaks as part of outplacement programmes and redundancy packages.

"Some people choose to take a career break and do something else for a while,” he said. “We can do psychometric testing and give general advice on their options."

Case study: Tina Kelly - a 'better employee' after her one-year career break

Tina Kelly, a consultant with recruitment firm Sigmar, recently returned to Ireland following a six month career break in Australia and New Zealand.

"I had spent a number of years in recruitment and had seen some very busy times in the market, and I felt that I needed a bit of a break,” said Kelly. “Some personal changes had also happened in my life at the time. I sat down and talked with my manager, she was very receptive to it, and I decided that I could take a year out and then come back after the year. I was told my job would be here when I came back."

"I took a year out from Sigmar, and I went travelling to Australia and New Zealand, and then I spent some time at home here," Kelly said. "I had a great six months away, and then I was back in Dublin for six months."

Kelly said her experience differed significantly from the typical post-university gap-year trip.

"I was a little bit older than most people who take a gap year," she said. "I was in my early 30s so I had some money behind me. I was able to do all the backpacking things, but I was also able to go for meals, get my hair done, and still maintain a good lifestyle."

"I really enjoyed it, I met all kinds of different people, saw things I would not normally see, and I came back much more interested in my work and refreshed in how I looked at things. I was very motivated and I was happier in myself, and therefore a better employee."

A growing number of candidates in Ireland have career breaks on their CVs, said Kelly.

"Quite, often I would come across candidates who have taken a career break," she said. “It seems to be becoming a more common choice for people of all age groups, and all types of professions and careers."

"You get a real mix of people taking career breaks for all kinds of different reasons. Sometimes it is for family reasons such as someone being sick, other times they want to travel. People often study while they were off, and voluntary work would also certainly come into it."

"It depends on the individual. Some people come back and have decided that they do not want to return to their old job, and decide to try something different," Kelly said. "Sometimes a change has occurred while they were away, and they now want to try something new. But a lot of people would look to get back into the same kind of role as before."

Kelly said that employers were not generally worried about gaps in a candidates work history on a CV, once the candidate could explain how they used the time beneficially.

"I do not think career breaks harm people professionally,” she said. “I have never come across an employer who would have a problem with a candidate who has taken a career break.”

Posted by

Dermot Corrigan

at

19:11

0

comments

![]()

Monday 1 December 2008

Redeployment is now a key issue

Sunday Business Post - Recruitment Page - Nov 30 2008

A creative approach to managing staff is needed to avoid job losses in an unsteady economy, writes Dermot Corrigan.

Companies under pressure are finding more creative ways to manage employees in order to stave off staff cuts and balance the books. Staff redeployment is top of the agenda for HR managers tasked with finding ways to boost revenues, according to a new report.

The SHL Ireland survey, released last week, found that redefining how staff operate was of “critical importance” to 59 per cent of the respondents it questioned.

HR practitioners in 100 organisations in Ireland responded to the SHL survey. 48 per cent identified the redeployment of existing staff between offices, divisions or roles as "an important strategy" in the current business climate.

"Companies are refocusing and looking to see what positions have the greatest possibility for revenue generation or for cutting costs," said Joe Ungemah, regional manager for Ireland, SHL. "They are looking across all the positions they have and saying which ones do we need to focus on if we have limited resources; which are the positions that have the greatest chance of bringing in money, sales people for example, and also research and development?"

In many cases, staff earmarked for redeployment are willing and qualified to move into more productive roles, Ungemah said.

“You have to think about what job families are closely related to each other,” he said. “When you are, for example, thinking of moving someone from an operations role into R&D, it comes down to whether someone has the right technical skills and experience. It may not be something they are using now, but they have learned it in the past."

52 per cent of the respondents surveyed by SHL said they had no plans to cut training budgets despite the downturn. Ungemah said that slower trading conditions were allowing some companies the space to train staff to fill different roles.

"The speed of economic growth over the last couple of years has meant that a lot of companies have not paid attention to keeping their internal HR processes up to date," he said. “Organisations realise that they just can not move people around without giving them the necessary support."

The SHL report found that 68 per cent of the companies surveyed were focusing on succession planning. Ungemah said that redeployment often had long-term career benefits for individual career progression, helping the succession planning process.

“A lot of specialists and managers may not have had the opportunity in recent years to gain experience outside their current job,” he said. “A mid-level manager who has always been pigeon-holed into a specific area might see a terrific opportunity to learn something new. It can be great for them in building their own CVs and getting to understand other parts of the business."

Internal restructuring is now a reality for a growing number of Irish employers, more than half of whom are operating with hiring freezes in place, said Janet Wallace, HR solutions consultant with Russell Brennan Keane.

"When people resign, retire or come to the end of their contract, they are just not being replaced,” Wallace said. “It is one of the easier options for companies to take when they see that things have to be tightened up. This is a way of reducing costs without having to make people redundant."

Pay cuts

Temporary and permanent pay cuts are now common practice in many Irish companies, according to Wallace.

"Davy Stockbrockers has announced that they were reducing their salaries across the board by ten per cent,” she said. “I know that many other companies in Ireland are doing that at the moment."

Wallace advised employers to apply pay-freezes or pay equally to all employees, or as part of a top-down initiative.

"Some companies introduce salary cuts on a phased basis," she said. "For example senior management are the first to take salary cuts. If the situation does not improve the fact that management took the pain first signals that they are leading the way. That can make it easier to implement cuts across all roles at a later stage."

Paula McGrath, managing director of Achievers Group, said that a bad reaction was not a given among staff facing a pay cut or pay freeze.

"Staff know a lot more about what is going on than most employers acknowledge, and they may be imagining the worst,” McGrath said. "It is more worrying to see a company not making commercial decisions. It is important to protect as many jobs as possible rather than burying heads in sand as this jeopardises the company and more jobs eventually.

Individuals who refuse to go along with suggested changes in their pay or conditions can cause problems for employers, McGrath said.

"By law, you have to honour somebody's contract of employment," she said. "If you are going to change any conditions, both parties have to agree. However, you can look to see if the person is delivering what is set down very clearly in their contract of employment and job specification. I know of organisations that start down that route if the person is not willing to play ball."

Creative solutions

McGrath said that organisations in financial difficulty were focusing on creative ways to reduce their payroll costs.

"Many companies are offering job share and modifying benefits such as reduced pay for increased holidays," she said. "Other individuals are being bought out of their trainee employment contracts. Bonuses are being acknowledged but deferred and overtime reduced by introducing flexible work practices.”

McGrath said that some roles were more suited to these steps than others.

"In sales related roles, in some organizations, we are seeing a reduction in basic salaries for existing staff and an increase in the potential to earn performance related pay and sales related commission," she said. “An employee who may relish the opportunity to establish himself independently and have more control over his work life balance can becomes self-employed with a contract arrangement.”

Managing change

Wallace said that it was important for organisations considering these steps to bear in mind their legal responsibilities.

"A change in the terms of employment needs to be put in writing and agreed with the employee before action is taken,” she said.

McGrath said that managers might be surprised at how open employees were to possible changes to their working arrangements.

"Small business owners are so engrossed in surviving that they might not realise that two staff have been talking and would be happy to job-share," she said. "I recently spoke with an individual in a large accountancy firm, who is willing to go down to four days a week, which will necessitate a drop in salary. She wants her job, and she wants to continue working for that company."

Wallace advised employers to ensure that very valuable and indispensable staff did not disengage from the company as a result of any changes introduced during the downturn.

"High performers will always find new roles and companies need to be working to identify the key roles that are critical for the future and the key staff they want to retain in those roles," she said. "While you may not be in a position to protect your key talent from some short term measures like bonus freeze or reduced working hours, you can provide reassurance to them that they are valued and viewed as critical to the future plans of the business and ask them to weather the storm with you."

Posted by

Dermot Corrigan

at

12:01

0

comments

![]()

Monday 24 November 2008

Eircom League looks to the future

Sunday Business Post - Business of Sport page - Nov 23 2008

Sunday Business Post - Business of Sport page - Nov 23 2008

See this article on the Sunday Business Post's website by clicking here.

Despite the downturn, the director of the League of Ireland believes that clubs are in a good position for the future, writes Dermot Corrigan.

Bohemians and Derry City take to the field at the RDS in Dublin today for the showpiece event of the Eircom League of Ireland calendar, the FAI Ford Cup final.

Bohemians enter the game as favourites, having easily secured the league title in an eventful season. In sporting terms, 2008 will be remembered as the year that Drogheda United almost toppled Dynamo Kiev in the Champions League, while Dundalk returned to the top division after securing promotion with the very last kick of the season. However, this year will also be remembered for less positive reasons.

Two clubs - last season’s champions Drogheda United and 2005 title winners Cork City - have gone into examinership in recent months, each with debts of about €750,000. More than half of the league’s clubs have been unable to pay their players in full or on time.

According to Fran Gavin, director of the League of Ireland, the problems faced by the clubs are not due to bad management, but are a very public example of how the downturn is affecting everyone in Irish society.

‘‘On the pitch, this has been a very good season,” said Gavin. ‘‘It has been one of the best ever years in Europe. Bohemians won the league in a record-breaking manner and the standard of play has been very high. ‘‘Off the pitch, it was not a good year for the league, but wage difficulties are not unique to the League of Ireland. Everybody running a business in Ireland today is seeing financial difficulties. Ours get highlighted on the back pages of newspapers, and the issues around Drogheda and Cork City have been well-documented.”

The ‘‘issues’’ have included Drogheda players threatening strike action after the club’s plan to sell its ground and move to a new €35 million, 10,000-seater stadium ran into planning difficulties. Cork’s problems arose after the club’s former owner - venture capital group Arkaga - withdrew its backing midway through the season.

Galway United was forced to sell key players in mid-season and imposed pay reductions on the players who remained.

Bohemians’ league win has also been overshadowed by a High Court case between the club and property developers over its relocation plans. Bohemian’s Dalymount Park site, in Phibsboro in Dublin, was valued at €60 million at the height of the property boom, but is now worth a lot less.

Gavin said that some clubs, like many other parts of Irish society, were over-reliant on the property and construction sectors. ‘‘The difficulties span not only the deals that were done with developers, but there were also sponsorship deals with developers and property companies,” he said.

‘‘Some clubs have then had difficulty receiving the sponsorship that was agreed. That was clearly due to the downturn in the economy, particularly in the building trade.”

However, many clubs faced difficulties even before the property bubble burst or the credit crunch hit. The 2005 Genesis Report stated that the league was ‘‘near to being economically bankrupt’’ and ‘‘unsustainable in its current format’’.

Gavin said that a lot had changed in the three years since that report. Two years ago, the FAI took over the running of the league from the member clubs. It has since imposed a licensing process, which includes a wage cap at 65 per cent of a club’s total income.

‘‘It was best practice last year, it is regulation this year,” said Gavin.

‘‘Clubs were paying 95 per cent of their income on players’ wages, which was the highest [percentage] in Europe. Now clubs that do not come under 65 per cent by the end of the season can be sanctioned. The sanctions can go as far as not receiving a licence for next year.”

Gavin said he was optimistic that all clubs would qualify for their 2009 league licences, despite the events of this year. ‘‘Everybody has learned a lot of lessons this year,” he said.

‘‘All 22 clubs have to go through the licensing procedure, and only when that is decided will we know the structure of the league. We will take it that the ten teams that qualified for the league next year will be there, unless we are told otherwise, and the fixtures will be set out accordingly.”

According to Gavin, the FAI is two years into a five-year plan to get the league onto a solid footing.

‘‘We are trying to make clubs more sustainable and community-based,” he said. ‘‘We will then have more credibility and attract more sponsors. It is a marathon, not a sprint, but we have changed the ethos of the league.”

Eliminating club debts had been a priority for the FAI, according to Gavin.

‘‘Last year, the total [debt] was €7 million. This year, that is projected for €3.5 million. Next year, the clubs will be debt-free. At the moment, money is being used by many clubs to service their old debt. If that is no longer needed, clubs can then invest in youth policies, facilities and in staff to make sure the club is run better.”

While Arkaga invested in Cork City as a business opportunity, Gavin did not think that Eircom league clubs were suited to being run for profit. ‘‘It is a difficult situation running a football club,” he said.

‘‘It is not something that you are going to get involved in to make a fortune. A break-even position for most clubs would be a successful season.”

Gavin cited links between Shamrock Rovers and South Dublin County Council as a more sustainable club ownership model. Rovers are due to take up residency in a new, local authority-funded stadium in Tallaght for the start of next season.

‘‘These relationships are like a public private partnership, where the county council recognises the social role played by the football club in communities,” he said.

‘‘There are similar partnerships in many Scandinavian countries.

‘‘There are several different setups within the league. St Patrick’s Athletic have a wealthy backer [property developer Garrett Kelleher] who sees a social responsibility to build up the club. Bohemians is a members-owned club. The most interesting one for us is the link between the club and the local authority.”

Gavin said that the FAI had shown its commitment to the domestic league by raising the prize money for winning the league to €250,000,up from€17,000 five years ago. The FAI Cup is worth another €100,000 to the victorious club.

‘‘Besides the prize money, we have also been working on issues like TV money, sponsorship and other commercial issues to try to help the clubs increase their revenue,” he said.

Another goal is to attract more people to games. Gavin said that attendances in 2007 were up 100,000 on the previous year, although the numbers going to games had levelled off in 2008.

‘‘For the last two years, premier league clubs have [had] a promotion officer working in schools and different parts of the local community, which we co-finance with the club,” he said.

‘‘Clubs that have these officers have seen their attendances increase, whereas clubs without them have not. Sligo Rovers are a fantastic example; their attendances are up 20 per cent this year.”

While Gavin said that it was inevitable that the best players would be attracted to play abroad, he said the priority was to ensure that Irish players were developed to the stage where they could be sold for a decent price.

In the past, players have been sold for small transfer fees - current Irish international Kevin Doyle was sold by Cork to Reading for €120,000 and three years later, is valued at more than €8 million. Cork last week sold their rights to 10 per cent of Doyle’s next transfer fee, to Reading for a sum thought to be in the region of €250,000.

‘‘We have invested heavily in getting our managers to have the UEFA pro licence, which is the top licence for managers in the world,” said Gavin. ‘‘That is reflected in their coaching abilities, and the players in the league have improved.

‘‘Players that are being looked at by English clubs are now a much better product, fitter and technically better, so you can command a higher fee for them."

Posted by

Dermot Corrigan

at

09:35

0

comments

![]()

Friday 21 November 2008

Disappearing Act

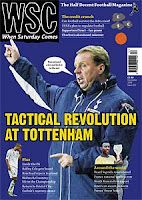

When Saturday Comes - December 2008

When Saturday Comes - December 2008

In August, Irish champions Drogheda United came within inches of eliminating Dynamo Kiev from the Champions League. Midfielder Shane Robinson saw his injury-time cross-shot diverted on to a post by Kiev keeper Taras Lutsenko, before the ball agonisingly rolled across the goalline with no Drogheda player on hand to tap home. Minutes earlier Adam Hughes had somehow fired over an open goal from six yards.

The rattled Ukrainians held out to squeeze through 4-3, then hammer Spartak Moscow 8-2 on aggregate to seal their place in the group stages. Drogheda were left ruing what might have been. The Drogheda players’ recent thoughts are likely to have been more prosaic, as they dwelled on issues such as how to pay their mortgages or put food on their family's table.

On October 9th they were told by club chairman Vincent Hoey that they would not be paid for the rest of the season. A week later the club went into receivership with reported debts of over €732,000 and were docked ten points. This deduction could be moot, as they may well disappear completely before the new season starts next spring. Things were much different just 12 months ago.

A (relatively) expensively assembled team, managed by Eircom league legend Paul Doolin, cruised to Drogheda's first ever national league title. This came after two Setanta Sports Cups and an FAI Cup in the preceding two years. The glory times had arrived for a previously yo-yo, small-town club. This season saw them ease past Estonian champions FC Levadia Tallinn 3-1 on aggregate, before running Kiev so close.

Such achievements were possible because of the estimated €8 million that had been poured into the club since 2004, when Hoey and fellow directors Christopher Byrne and Eugene O'Connor rolled out their masterplan. They aimed to sell current ground United Park, which holds only 2,000 fans, and use the proceeds to fund a new €35m 10,000-seat stadium outside the town, while also developing residential units, offices and leisure facilities on the old site. The idea was initially hailed as visionary, and the board does appear to have the best interests of the club at heart, but planning issues have bedevilled the project and it remains on the drawing board. Meanwhile, their financial over-reach means that Drogheda's 27 players and 12 staff could well be out of a job by Christmas.

As this issue of WSC is still on sale, I'm not putting the whole article up on the site. Click here to purchase a copy of the magazine, or here to visit the WSC website.

Posted by

Dermot Corrigan

at

17:13

0

comments

![]()

Monday 17 November 2008

Nowcasting International signs €300k Canadian deal

Sunday Business Post - Done Deal page - Nov 16 2008

See this article on the Sunday Business Post's website by clicking here.

Irish company Nowcasting International has signed a €300,000 deal with Canadian global energy giant Nexen to provide weather forecasting services.

Mark White, chief executive of Nowcasting International, said the three-year agreement would service Nexen operations in the North Sea.

‘‘We are providing them with high-resolution weather data, and detailed meteorological and oceanographic services,” he said. ‘‘Nexen has several producing and drilling assets in the North Sea that require accurate and detailed weather forecasting, to safely undertake operations and to maximise the use of its assets.

‘‘We do not just pump lots of weather information to it, we give it to Nexen using software installed on its computers, which are Irish-designed. This solution allows it to get answers to its questions and identify weather windows, taking into account wave heights, wind speed or current speed and direction.”

The deal was finalised following a competitive four-month tendering process, White said.

‘‘We have a senior sales executive based full-time in Aberdeen,” he said. ‘‘It was a relatively quick deal for us, but we had been introducing it to our technology over the last year.”

Nowcasting was established in 1999, with initial funding from Eircom Enterprise Fund, Shannon Development and Mayfair Venture Capital.

The company delivers weather information provided by partner companies to customers using its patented Nowcast Pro technology. Customers include ferry operators, navies, coastguards, offshore oil and gas operators, shipping companies and individual boat owners.

‘‘When we started out, we had to establish credibility, as we were up against people like Met Éireann and UK Met Office,” said White. ‘‘We did a deal with HM Customs and Excise in 2002 to switch from UK Met Office, which was a big breakthrough for us and helped us to get current customers like BT and Chevron.”

Nowcasting employs 16 staff at offices in Ennis and turned over €3million in 2007. White said an agreement signed in 2003 with US company Wilkens Weather Technologies had enabled it to offer a competitive service to oil and gas companies in the North Sea.

‘‘Together, we have established a North Sea weather centre in Aberdeen,” he said. ‘‘We have four forecasters there providing a 24-7 service, which gives us a very strong position to compete with the likes of UK Met Office for this kind of business.”

Nowcasting’s partnerships with international weather data suppliers enable it to service customers in the Gulf of Mexico, Brazil, the Mediterranean, west Africa and Russia, White said.

The company recently launched online consumer forecasting service Askmoby.com, which won the Silver Award for Most Innovative Business Model at the Mobile Search Awards 2008, held in London last month.

‘‘It allows users on mobile phones and PCs hour-by-hour weather forecast for anywhere in Europe for a particular activity,” said White. ‘‘They get a free forecast, and a very specific ad focused on the activity and weather they will get.”

Posted by

Dermot Corrigan

at

10:14

0

comments

![]()

Monday 10 November 2008

Griffith College signs €3m Chinese deal

Sunday Business Post - Done Deal page - Nov 09 2008

See this article on the Sunday Business Post's website by clicking here.

Griffith College in Dublin has agreed partnership deals valued at €3 million to accept students from four Chinese colleges.

Griffith college president Diarmuid Hegarty said the deals would boost college revenues with the addition of up to 300 new students annually.

As a result of the agreements with Huazhong University of Science and Technology (HUST),Yangtze University, Hebei College of Finance (HCF) and Beijing International Studies University (BISTU), Hegarty said the students would take part in business and IT degree programmes run by Griffith College.

‘‘We expect to get 300 more students coming here out of the new arrangements,” he said. ‘‘With an average of €10,000 per student, we get the €3 million figure.”

Under the arrangement with HCF, Griffith will establish a new Association of Chartered Certified Accountant s (ACCA) teaching department. For BISTU, it will develop a special international degree in accounting and finance.

Chinese students from all four institutions will be able to use their studies at Griffith College towards their final degree qualifications at home, Hegarty said.

‘‘The Chinese universities will amend their programmes so students can effectively cover there what our degrees cover in the first two years,” he said.

‘‘Typically, students do two years in China and then one or two years here in Ireland.” Hegarty valued the new agreements at €6 million annually to the wider Irish economy.

‘‘Each student probably spends €10,000 while living here, on travel, accommodation and subsistence,” he said.

Griffith College already has articulation agreements in place with three other universities in Beijing and Shanghai, plus an office in Beijing employing three staff locally.

Prior to this latest deal, 500 Chinese students attended Griffith courses in Ireland each year, generating €5 million in revenues for the college, Hegarty said.

He said the college had worked hard since 1994 to build relationships with institutions and individuals around China. ‘‘We are now the best known Irish education institution in China,” he said.

‘‘It is all about developing personal relationships and staying in constant contact. You do not develop these contacts overnight, you go over there and meet with them and work with them to gain their trust.”

Five hundred accountancy students attend a Russian college established by Griffith in Moscow in 2002. It also has more than 140 collaboration agreements with colleges in the US, Europe and Asia.

Posted by

Dermot Corrigan

at

09:56

0

comments

![]()

Monday 3 November 2008

Website investment is shrewd marketing

Sunday Business Post - Computers in Business Magazine - November 2 2008

See this article on the Sunday Business Post's website by clicking here.

As the public tighten their belts, surfing online when considering a purchase will become more popular, so companies should ensure they have an attractive website, writes Dermot Corrigan.

Hard times are upon us, according to the experts. Even if they aren't, the perception is such that they may as well be. This means that customers are going to start looking to reduce costs. And many of them will start to spend more time online, given its association with cut-price products and services.

So the smart company preparing for an extended downturn should think of investing in a proper website now.

"When people are looking for cheaper products or services, whether it is airline flights or lawnmowers, they are going to go online," said Martin Casey, managing director of web design and internet consultancy firm Arekibo.

"When things are tighter and they have less money in their pockets, they are going to start looking more and more online to get the best deal."

Casey said that nowadays most customers look to the internet first when considering any kind of purchase, therefore companies should ensure they present the best possible online image.

"The internet has become the de facto reference point for people to find services," he said. "Everyone is going to Google or Yahoo. The website is your virtual front door, it gives the customer an insight into who you are, what you do, and how you treat people. It is vital in times like these that your internet is very much at the front of what you are trying to achieve with your business."

Developing a website as an alternative sales channel should be a key objective for many businesses faced with challenging markets, according to Casey.

"A website is not more important than having more sales people, because the internet site is a channel for introducing customers to your team," he said. "But it has to be part and parcel of supporting your organisation to sell your services. If you have fewer people to do the selling, then the internet site is there to support that."

Michele Neylon, managing director of hosting services provider Blacknight Solutions, said that not all Irish businesses, of all shapes and sizes, had yet realised the importance of their web presence to their business.

"There are still a lot of Irish businesses who have not yet fully understood what the internet is, and what they can do with it," said Neylon. "We get people contacting us who still do not understand the difference between an e-mail address and a domain name. The general level of knowledge has improved, but there is still a surprising level of misunderstanding.

"It is not just small businesses; for example, it is still impossible for customers to e-mail their local AIB branch, as the AIB branch network does not have access to e-mail. Within that environment it is hard to expect small businesses to get a handle on all the possibilities of ecommerce."

Maryrose Lyons, managing director of Brightspark Consulting, said that, while some very bad websites still existed, most Irish companies now had reasonably well-designed and well-thought out sites.

"I am happy to say that most Irish company websites have improved over the last half decade,’' said Lyons. "I run a web writing training course and part of the preparation for that is to find examples of what not to do. "And I have to say it's getting harder and harder to find some real whammies. That said, there are some shocking sites out there - many from larger companies that ought to know better. I can not understand how some businesses that understand the importance of design in their own products can allow themselves to be portrayed online with this kind of thing you sometimes see."

Fiachra O'Marcaigh, director of online consultancy Amas, said that smaller organisations often had better websites than larger competitors. "Smaller companies are often more innovative and more energetic in their use of online channels than larger ones," said O'Marcaigh. "Most companies now recognise that a good website is not a luxury, it's an absolute necessity."

What makes a good site

O'Marcaigh said that companies should think carefully about what exactly they wanted their website to do for them. "Clear thinking about what your messages or selling points are is vital," he said. "Without this, you simply cannot create an effective site. Once you know your own goals and messages clearly, focus on your users and what they want, need and know. Design your site for your users, not for yourself or your peers."

Companies should consider what business objectives they want their website to meet, according to Gary Cosgrave, sales director with Webtrade. "The most important thing for a website is to lead the searcher to a completed action in the shortest time possible," he said.

"That completed action depends on what your business type is, or what your business model is. It might be to get the customer to the piece of furniture that they want to buy as quickly as possible and purchase it online. "You have to make sure that the user interface design and the information architecture are structured in a certain way that people get what they want, what you want, and so that they do not get lost on the site."

Casey advised businesses to work out criteria for measuring a site's success "We want to set an understanding of how they are going to measure success from the start," he said. "When we are planning the site that is very important. Is it more queries or people calling you, more sales online, is it helping you to represent your organisation better? These are things that help the client understand and measure what their investment means."

Content

Lyons said that businesses should not try to use their websites to just store as much content and sales material as possible.

"Most businesses have an abundance of content lying around in sales material, proposals, strategic plans, product specs and the like," she said. "The trick here is not to simply dump all of this information on to your website. We read 25 per cent less off a computer screen, so write 50 per cent less. Be ruthless about culling your content. Rewrite it in a web friendly way. Use bullets instead of paragraphs. Use short sentences and no jargon." Different companies will want to promote different aspects of their business, and hence use different types of content, according to O ¨ Marcaigh.

"The kind of content that an SME publishes should be valuable to its online audiences and support the goals of the business, as set out in its online strategy," he said. "This will vary widely, from one business to another. For example, a bicycle shop may sponsor local races and post news and results to its website. A legal firm might publish a newsletter of legal news from the areas of law that it specialises in."

Fergal O'Byrne, chief executive of the Irish Internet Association, said that all business websites should be regularly updated. "Updating content on a website is key to keeping it fresh and interesting," he said. "It also ensures that users have confidence that the company behind the site is still in business! How many times have you been turned off a site because the last news item was two years old? Search engines also reward content that is updated regularly.

Search engine optimisation

Ensuring that your site is ranked high in Google or other search engine searches is a key consideration for all business websites, according to O'Byrne.

"Ideally, search engine optimisation (SEO) should be considered when the site is being designed," he said. "Most of the good web design companies build sites that are search engine friendly and stand the best chance of being found in the main search engines (Google, Yahoo, MSN). SEO is an on-going process and companies need to constantly check where they are showing in the search engines and for what search terms."

Lyons outlined a number of SEO strategies. "Search engine optimisation has always been a bit of a black art," she said. "With the advent of Google, it has evolved to become a very specialised and technical part of the industry. The days of sticking a few keywords into your metadata are long over.

"Today's number one rankings are more a result of detailed keyword and competitive analysis, followed by labour-intensive, time-consuming link building activity. As a result, search engine optimisation is not cheap. For certain competitive keywords, you can almost expect to spend the same amount on optimising the site as you spent on building it."

E-commerce

E-commerce options and functionality figure prominently in many web strategies, O ¨ Marcaigh said. "Not every company needs e-commerce, but they certainly need to consider it carefully," he said.

"Consumers and businesses in a business to business context value the convenience of sourcing goods and services online. Increasingly, they want to be able to transact and buy online also. "Provided that the business is possible to carry out online, then companies should look carefully at the benefits, such as greater reach, lower cost of sales and other, as well as the downsides: set-up cost, fraud risk and the need to manage the channel." Lyons said there were various e-commerce systems available to suit the requirements of the company.

"If your business is involved in selling product and you are considering developing an e-commerce website, you can begin by offering payment with Paypal," she said. "This is the lowest fee level, good for very small businesses where brand is not an issue. If you are already a retailer and have credit card processing facilities then you can go for manual processing of transactions. "If you are really serious about e-commerce and are getting the volumes, then automatic card processing is a must. I recommend Realex because their systems are robust and the team there is super helpful and easy to deal with." O'Byrne said that some companies do not need an e-commerce element to their site.

"A company must establish whether the investment in an online booking or payments system will make a return on their investment," he said. "For example for a small B&B it may not be prudent to spend their budget on a real-time booking system. A simple availability calendar might be more useful and the remaining budget could be spent on an online marketing campaign via a service like Google Adwords, for example." However, that did not mean the website should be not be designed to encourage the browser in a particular direction, Cosgrave said.

"Some companies do not need a transactional element, so we can just make sure that it is an information rich, brochure type site," he said. "With that kind of site we are trying to lead the searcher to complete the contact us form to make direct contact with the customer, rather than actually making a purchase."

Bells and whistles

Recent years have seen increased interest in so-called Web 2.0 or interactive website features, such as blogs, forums, podcasts, really simple syndication (RSS), regular newsletters, etc, all of which allow businesses to communicate directly with their customers. However, Lyons advised businesses against adding too many unfocused bells and whistles to their sites.

"Only introduce elements that your target audience will use," she said. "If you are marketing to a youth audience for example, it's likely they will all have iPods, so a podcast might be a better way to get your message across than an e-mail newsletter. "However, e-mail newsletters remain one of the most effective ways to communicate with a business audience. Blogs are also great and as more people are using RSS, this will continue to be so. The ideal is to have a blog and then repackage the popular posts as the content for your newsletter. You can use Google Maps instead of a picture of the building.

"Use functionality that will make the visitor's experience easier and richer, not functionality that has no purpose - like those awful ‘skip intro' pages." O'Byrne said that smaller companies could use innovative websites to compete in larger global markets. "One of the best SME examples of embracing all these elements is worldwidecycles.com," he said.

"This Clonmel based specialist cycling shop allows potential customers from al l around the world to take a Virtual Tour of the physical shop via an embedded YouTube video, promotes an active blog, and utilises the photo sharing facility, Flickr. The end result is a sense of engagement and interactivity for the potential customer and returning client alike." Lyons said that the next few years would see even smaller websites evolving their websites to incorporate less text and more multimedia.

"We are seeing an increase in video content across many industries," she said. "If you need to communicate a message with an audience who are used to using websites and are perhaps a little tired of being presented with large amounts of text, then a short video can carrying your key messages can be more effective. "There will be a move away from the large 50-100 page sites that were driven by content management systems, back to short, punchy five or ten page sites using a mix of video, text and imagery to convey a message. Kanchi.org is a good example of that."

Nuts and bolts

O'Byrne said that most Irish companies now managed the day to day updating and maintenance of their website using simple content management systems (CMS).

"ACMS is an easy to use tool that allows a nontechnical user to update content, often text on the pages of a site and other elements like photos or pictures," he said. "In most cases it does not allow the user to break the site or interfere with the design template, which is a good thing." Gary Cosgrave, sales director of Webtrade, said that web design companies generally trained their customers on how to update their own sites using customised CMSs.

"Our CMS is designed specifically for the non technical users, and we train people to use it," he said. "It means you are not reliant either on internal technical staff or external consultants.

"You log in using your username and password, and you are actually editing what you see on the website. You click on a navigational button to add a page, edit a page et cetera. You get into a WYSIWYG (what you see is what you get) or text editor, which is pretty much the same as Word. If you can use Word, you can use the CMS." Often the updating of a company's website is not done by an IT expert, Casey said. "The fundamental change that has happened over the last few years is that marketing people have begun to look after the websites," he said.

"These people do not have time to be sent on a course to learn HTML. We would have a client trained up in two to three hours maximum, and they would be able to manage every aspect of the website, add pages, extra products, news and events et cetera." Neylon said that companies could benefit from analytics tools that let them see exactly how visitors are interacting with the website, including which pages and elements of the site were most popular.

"You can see which pages of your website people have visited, which elements within those pages that they have clicked on, where they spent more time," he said. "You can really see which things are working well and which things are not."

Hosting

Most Irish companies now outsource the hosting of their websites, according to Neylon. "Only very big companies would host their website in house," he said.

"Realistically speaking to do your own hosting, you need technical expertise and the infrastructure in place with a server connected to the internet 24 hours a day, seven days a week.You need stable internet connections, backups et cetera, it is not something that most small businesses are going to deal with." While Irish sites can be hosted on servers anywhere in the world, O'Byrne advised Irish companies to deal with local hosting companies.

"We always advise companies doing business in Ireland to host their websites here," he said.’ ‘It is reassuring to know that there is a physical presence behind the hosting company, that is contactable during your normal office hours." Hosting costs have fallen dramatically in recent years, according to Neylon. "The price has been pushed down on the hosting packages, and the services are being increased all the time," he said. "For €50 a year you can get a huge amount of disk space and oodles of everything else."

Whether to go for a dot.ie or dotcom web address can be a poser for companies, O ¨ Marcaigh said. "If possible, companies should register both and then decide which domain to focus on for marketing themselves," he said. "To generalise, the .com domain presents a more international air, while .ie is clearly Irish-oriented.

"For a company focused in the first place on the home market, using .ie puts them closer to their Irish customers. That helps to establish trust more readily. They should also consider registering the .co.uk domain name and look at any other markets that may be relevant to them in the future." Neylon said that his customers chose a mixture of .ie and .com addresses, however .ie addresses, only available from the IEDR (.ie Domain Registry), were sometimes more difficult to register and set up.

"You can register and get a .com or .co.uk up and running in about half an hour if the name is available," he said. "To get a .ie you have to be a registered business, or a limited company with a business name the same or close to the domain you want to register, or you have to contact them and persuade them to allow you to have the name."

Posted by

Dermot Corrigan

at

11:46

2

comments

![]()

Get more fibre in business diet

Sunday Business Post - Computers in Business Magazine - November 2 2008

See this article on the Sunday Business Post's website by clicking here.